kentucky sales tax on-farm vehicles

For example Kentucky exempts from tax feed farm. SALES AND USE TAX The sales and use tax was first levied in its current form in 1960.

The 2022 Pennsylvania Agriculture Power 100 City State Pennsylvania

Or vehicles with 3 or more axles regardless of weight to.

. Printable Kentucky Farm Certificate of Exemption Form 51A158 for making sales tax free purchases in Kentucky. Kentucky Sales Tax information registration support. You can easily access coupons about Kentucky Sales Tax On Farm Vehicles Silvana Eckert by clicking on the most relevant deal below.

Exempt from additional fuel usage tax in. For vehicles that are being rented or leased see see taxation of leases and rentals. KRS 138477 imposes a new excise tax on electric vehicle power distributed by an electric power dealer to charge electric vehicles in the state at the rate of three cents 003 per kilowatt.

In addition to taxes car. Kentucky Sales Tax Guide - Chamber. Free Unlimited Searches Try Now.

650 Definitions for KRS 186650 to. This license is required for interstate carriers with a gross vehicle weight or a registered gross vehicle weight exceeding 26000 lbs. Kentucky Sales Tax Rate - 2022.

To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. Are services subject to sales tax in Kentucky. For example an item that costs 100 will have a tax of 6 for a total of 106 100 times 06 equals.

In the farm vehicles that will be traveling on federal state and county highways. Ad Get Kentucky Tax Rate By Zip. A taxpayers sales tax return generally must be filed by the 20th of the month following the reporting period unless the Kentucky Department of Revenue authorizes.

Ad New State Sales Tax Registration. How to Calculate Kentucky Sales Tax on a Car. To calculate Kentuckys sales and use tax multiply the purchase price by 6 percent 006.

650 Definitions for KRS 186650 to. For Kentucky it will always be at 6. State Tax Rates.

Exempt from weight distance tax in Kentucky KYU. Kentucky collects a 6 state sales tax rate on the purchase of all vehicles. For Kentucky it will always be at 6.

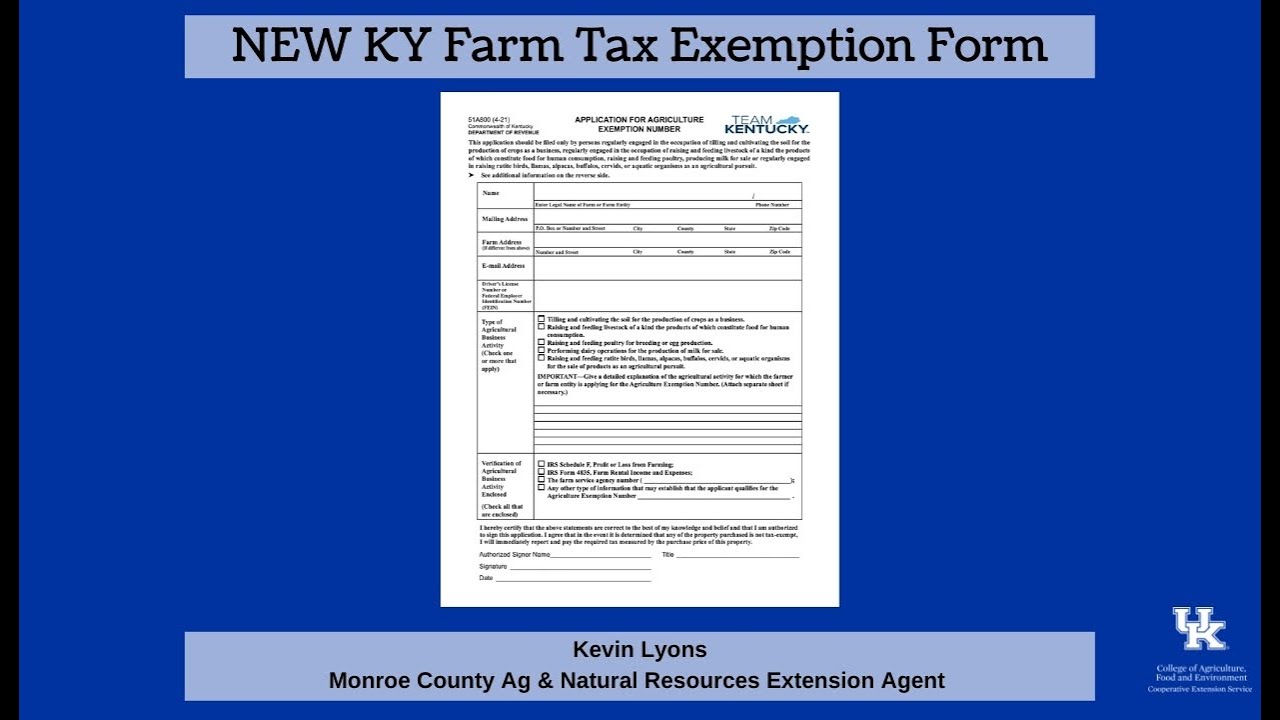

Agriculture Exemption Number Now Required For Tax Exemption On Farm Purchases Agricultural Economics

New York Sales Tax For Your Auto Dealership

10 Farm Tractor Salvage Yards In Kentucky 2021 Farming Base

Bill Seeks Higher Kentucky Gas Tax New Fees For Most Vehicles In Depth Wdrb Com

Ford Brothers Fall Farm Machinery Vehicles Equipment Recreational Vehicle Online Consignment Auction

What Transactions Are Subject To The Sales Tax In Kentucky

5 Tax Tips Every Farmer Should Know About Credit Karma

Kentucky Hurting While Awaiting Federal Pandemic Aid The New York Times

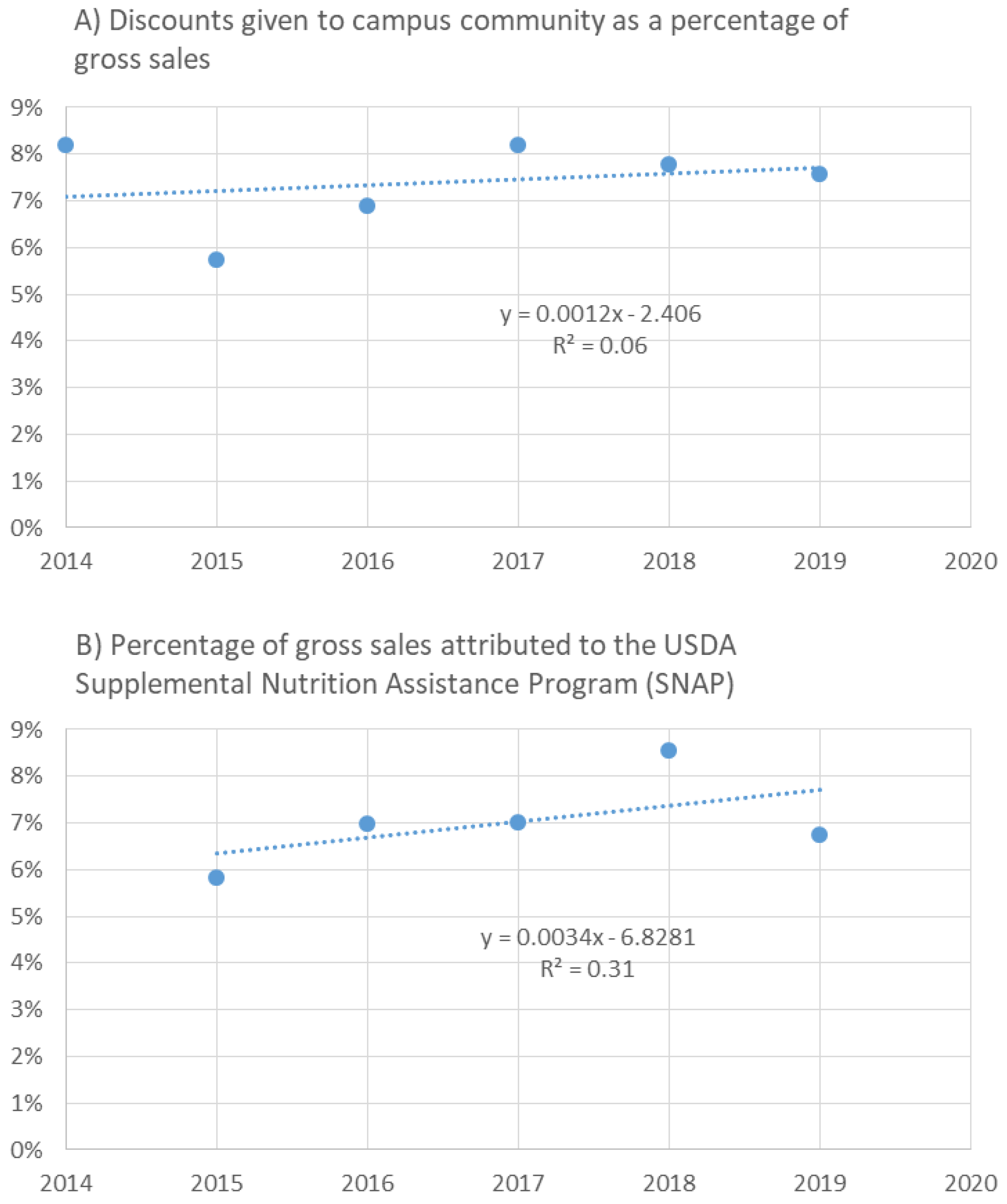

Sustainability Free Full Text Financial Viability Of An On Farm Processing And Retail Enterprise A Case Study Of Value Added Agriculture In Rural Kentucky Usa Html

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Kentucky Solar Farm Invite Is Not Sitting Well With Rural Neighbors

Kentucky Hay And Farm Equipment For Sale Facebook

Filing A Kentucky State Tax Return Credit Karma

Kentucky Sales Tax Small Business Guide Truic

Time Has Come For U S Farms To Cut Methane Emissions Agriculture Secretary Reuters